By Ekerete Ola Gam-Ikon

The discourse on National Minimum Wage has been there long enough for some of us to recognize that except there are new approaches in the negotiations, we are unlikely to see the ray of light in the tunnel.

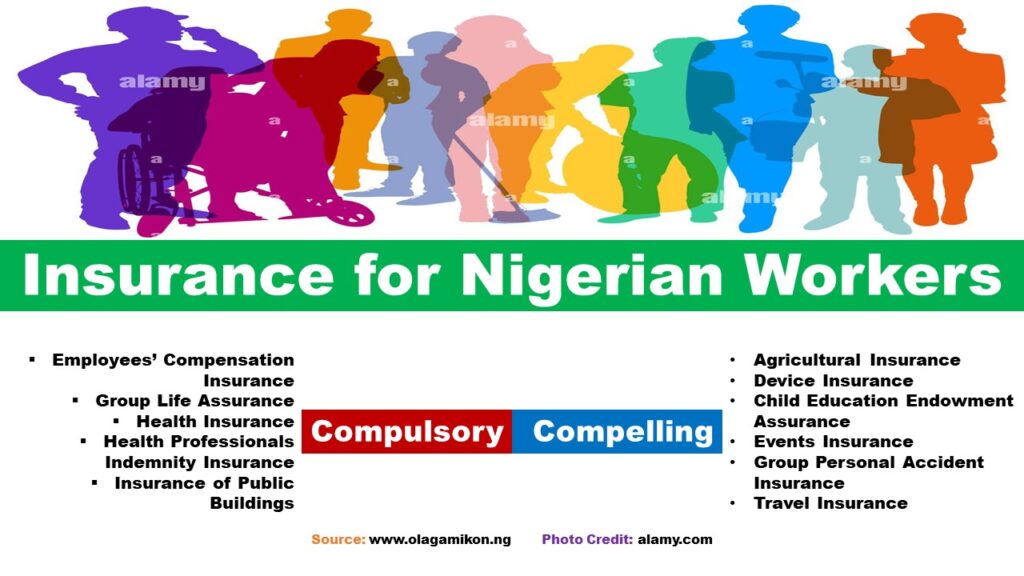

From an insurance perspective, I decided to interrogate the issue by examining what Nigerian Workers spend their National Minimum Wage on. This exercise has revealed that some of the expense sub-headings have been taken care of by Insurance, directly and indirectly.

Besides the basic needs of food, clothing, house and transport, we have education, healthcare, electricity, investment, family support, and importantly, airtime and data, which Nigerian Workers spend money on.

The National Minimum Wage certainly needs to be increased but the ability and capability of the Governments at all levels to pay would require insurance contents defined by our National Laws.

Does the Labour Unions know that they can DEMAND that the Federal, States and Local Governments provide the Compulsory Insurance Coverages for them and somehow reduce their spendings on healthcare?

Here are our pieces of advice:

ADVICE 1: To the negotiators on the table, consider the Compulsory Insurance Coverages as part of the National Minimum Wage.

If all Nigerian Workers are given access to Employees Compensation Insurance, Group Life Assurance and Health Insurance as required by the laws expressed in the Employees Compensation Act 2010, Pension Reforms Act 2014 and National Health Insurance Authority Act 2022 respectively, the discussions will certainly be adjusted on both sides.

What this means is that Nigerian Workers will receive medicare when they’re injured or ill in the course of work instead of spending from their pockets. Also, in the event of death, the families will receive minimum of 3X the total emoluments of the Workers!

These insurance policies ought to be in place.

ADVICE 2: To the Governments at all levels, provide insurance coverages for Nigerian Workers to give them a sense of stability and save us from corrupt officials that would rather have it today because tomorrow isn’t guaranteed.

When appropriate insurance coverages are in place including pensions, Nigerian Workers can begin to believe there is a future for them.

Insurance is a safety valve for long-term careerists, let’s give it to them.

ADVICE 3: All Nigerian Workers should consider the Compelling Insurance Coverages to enable them retain most of their National Minimum Wage when paid.

The education of children is as risky as the time spent in commuting between homes and offices. You are exposed to the same risks of what can stop your child from completing his/her education and when you are on your way to work: Accidents and Disabilities!

There are insurance coverages to help you handle such challenges. Get them while you can now, the economic harshness may not run its cycle but will certainly leave victims on its path.

Please know that as a Nigerian Worker, you deserve to have insurance work for you according to the laws. Let the discussions and negotiations change.

That ALL Vehicles on Nigerian roads must have genuine insurance coverages and ALL Public Buildings must be duly insured are further legislations to safeguard the lives of Nigerian Workers. Demand them now!

These advices are based on best practices. There are countries where we have 100 percent Health Insurance Coverages for all citizens. When are we going to get there if Nigerian Workers are not demanding Governments at all levels to respect the laws and honour their obligations regarding insurance coverages.

We have been on this curve for too long, let’s change the discussions and negotiations now.

Hope these advices help us to have a better workforce, and a better country.

A country is as good as her workforce!

Happy New Month of M.A.R.C.H. – Making Assurance Respond Creates Harmony!

I remain…

Assuredly Yours,

Ekerete Ola Gam-Ikon

NCRIB NAC Award Winner

+234-802-585-0344

www.olagamikon.ng

Good production costs money and you can support what we do. Please find our details below👇🏾👇🏾👇🏾 Account name: MARKET ONLINE MEDIA Bank: UBA Acc No: 1026401930.