Yes, insurance is a law that has fines and terms of imprisonment prescribed for violators and defaulters, just like tax.

However, the huge difference is that, with compulsory classes of insurance like Motor, Buildings, Marine and Aviation, the Federal Government seemingly have licensed insurance companies acting on its behalf, taking it as a full business while with tax, its agency, FIRS collects tax directly for government and that’s her revenue.

Government relies on taxes, levies and fines as revenue to survive.

Now, here’s the question that came to mind: Is government not losing revenue by failing to engage members of the public for evidence of their insurance policies?

Licensed insurance companies only engage the insurable public for premiums while nobody is chasing us to enforce compliance with the insurance law.

Should FIRS have a Directorate to handle compliance with the compulsory classes of insurance and ensure payment of fines in line with the insurance laws or should there be an entirely “new entity” created to handle this, since the insurance regulator does not have the powers to prosecute these violators and defaulters?

Think about this…if FIRS has to collect the insurance fines, the revenue base of the Federal Government will expand whilst creating more opportunities for sales of insurance policies.

Tax Clearance Certificate will go with Insurance Clearance Certificate. Individuals and organizations will submit verified evidence of the insurance of their vehicles, buildings and employees.

Of course, this will start another battle with many insurance professionals thinking I’m suggesting the opportunity should be taken away from the insurance industry but this is a revenue generating opportunity, which is outside the remit of the insurance regulator, NAICOM.

Ultimately, it is the insurance industry that win gain more, in my view, and it’s an opportunity worth pursuing. Or what do you think?

The fear about tax and the negative effect we often think it has on us and our businesses will be cushioned by insurance that exist to provide the resilience we have continued to enjoy in the face of increasing risks.

Recognizing that insurance is a law becomes necessary for how we plan and live our personal lives and how we strategically position our businesses for the future.

The dimensions of growth opportunities for the insurance industry in Nigeria are available and accessible but requires bold insurance operators to look beyond the fences and barricades holding them back.

Indeed, the “Insurance War” I started discussing last week has gone beyond what I described.

We’re going to continue discussing it until potential and existing customers (policyholders) understand that the insurance industry in Nigeria holds many opportunities they ignore to their detriment.

When you understand insurance enough to demand that governments at all levels comply with the laws and provide insurance coverages (life, health, buildings etc) as required for all her workers, you’ll be changing livelihoods without knowing.

Let this discussion go live and continue. We all need it.

You’re sure your comments and questions will be answered.

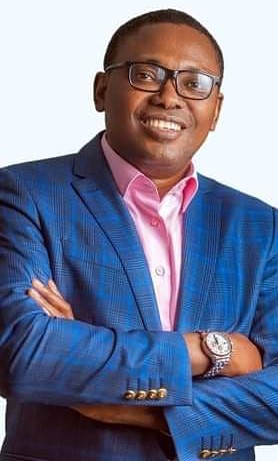

I remain…

Assuredly Yours,

Ekerete Ola Gam-Ikon

+234-802-585-0344

olagamola@gmail.com

Good production costs money and you can support what we do. Please find our details below👇🏾👇🏾👇🏾 Account name: MARKET ONLINE MEDIA Bank: UBA Acc No: 1026401930.