Nigeria has launched the Insurance Sector 10-Year Strategic Roadmap and Guidance Note for the Insurances of Government Assets and Liabilities.

This was at the 2023 National Insurance Conference which held at the Ladi Kwali Hall, Abuja Continental Hotel which served as an avenue for stakeholders to discuss current and emerging issues, generate ideas and insights which can be transformed into actionable strategies for effective enforcement of compulsory insurances by relevant authorities and agencies of government with the hope of ushering in a new era of collaboration to facilitate improvement in National Safety Standards.

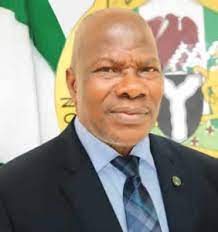

Speaking at the conference, Olorundare Sunday Thomas, National Insurance Commissioner said the Commission under his leadership has remained resilient and focused on implementing initiatives that will foster development of the Nigerian insurance industry and align its fortune with that of the nation as the Africa largest economy. He highlighted a total of seven flagship projects being implemented by the Commission as part of the its medium term NAICOM Strategic Plan 2021–2023.

“Notwithstanding the growth that had been sustained, the roadmap enumerated some of the challenges affecting the desired growth of the insurance industry which had persisted, such as: Talent gap, Comparatively low public awareness, Insurance affordability, Lack of trust and confidence in insurers, Cultural and religious bias, Inadequate distribution channels, Low enforcement of insurance, and others”, he said.

In terms of its performance Mr. Thomas said, the industry premium income between 2014 and 2022 grew at an average of 13.6%; from a premium income of N282 Billion to N726.2 Billion. The total assets of the sector also grew at an average of 12% for the same period; from an asset base of N827.5 Billion in 2014 to N2.33 Trillion in 2022.

For the next decade (2024-2033), the Insurance industry, the commissioner said will seek to continue its transformation journey along Seven (7) strategic thrusts with the objective of achieving the corresponding goals that include Transform the regulatory environment to sustain the industry growth; Transition to risk-based capital model; Promote insurance awareness and adoption; Broaden insurance product offerings and improve effectiveness of distribution channels; Enhance digitalization of the insurance industry; Deepen the industry’s talent pool and capabilities; and Support Nigeria’s economic transformation and sustainability agenda. “The Conference with the theme “Redefining Safety – Insurance Solutions for Public Buildings and Buildings under Construction” is only one out of numerous efforts of the Commission at creating the needed awareness of the general public of compulsory insurances. It has also created the platform to strengthen collaboration with relevant government and non-government agencies and other stakeholders”, he said.

The conference ends October 24, 2023.

Good production costs money and you can support what we do. Please find our details below👇🏾👇🏾👇🏾 Account name: MARKET ONLINE MEDIA Bank: UBA Acc No: 1026401930.